Today I continue my in depth review of Michael Jackson’s Trust. Part 1 is here, and you can download a full copy of the Trust here. Today we start talking about the real meat of the trust — the dispositive provisions. In other words, who gets what?

Article Three of the Trust provides that upon Jackson’s death, the Trust estate is to be divided as follows:

- Twenty percent is to be distributed off the top to various children’s charities that are to be selected to a committee made up of his mother, John Branca, and John McClain.

- After the 20% to children’s charities, the Trustees are to pay the various debts and expenses of the estate, including the estate tax.

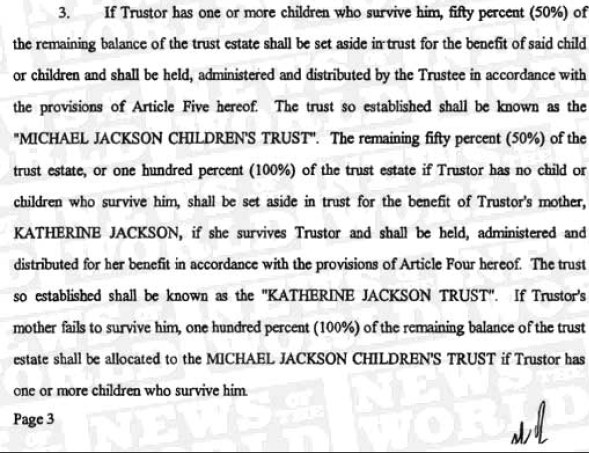

- Fifty percent of what’s left, i.e. 80% minus the fees and costs paid in #2 to be held in a new Trust for his children; and

- The other fifty percent of what’s left to be held in a new Trust for his mother, Katherine Jackson.

- If none of his children survived him, then 100% of what was left after #1 and #2 above would go into the Trust for his mother, Katherine

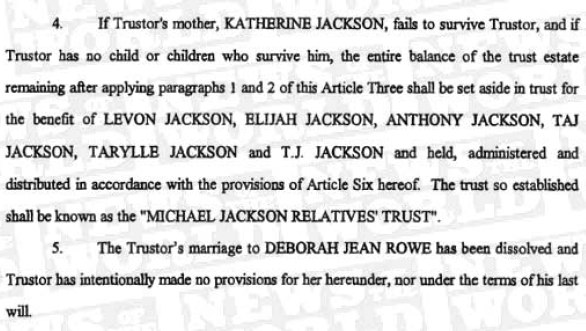

- If neither his mother, nor all of his children survived him, then the property would be held in trust for his nieces and nephews, “Levon Jackson, Elijah Jackson, Anthony Jackson, Taj Jackson, Tarylle Jackson, and T.J. Jackson”

- Finally, the Trust specifically states that Jackson’s marriage to Debbie Rowe has been dissolved and that he intentionally has made no provisions for her.

I will begin discussing the Trusts set up for his children and his mother in the next post.